Data Security in Banking Industry: Its Importance, Threats and Solutions

The banking industry evolved spontaneously in the last decades like every other industry. The financial sector embraced new technology and found ways to implement a “customer first” approach to its services. While we acknowledge the benefits it brings (ATMs, mobile apps, online customer care, etc.), we see and fear the dangers that follow. This adoption of digital tools shows a strong need to prioritise data security in the banking industry. To prove the relentless onslaught of cyberthreats, cybersecurity ventures estimate the global cybercrime cost will reach $10.5 trillion by 2025. Also, statistica ranks the financial sector 2nd based on the average cost of a data breach. So what’s next? Premium data security! In this blog, we’ll go over the importance of data security in the banking industry, threats to it, and how to solve them. Why is Data Security Important For Banks? One thing every industry runs by is data, and the banking sector isn’t left out. There’s a lot of data out there, and banks make use of a wide range. Yes, they use, handle, and store basic personal data like name, age, address, etc., but there are more delicate data at stake (BVN, NIN, credit card details, etc.). These kinds of data attract cybercriminals who use them for financial frauds, identity thefts, targeted attacks, and many more. So, stopping malicious actors from accessing sensitive data remains the ultimate goal for the banking industry. But that’s not all; there are other consequences of cyberthreats that data security curbs. Some are; Loss of Trust and Reputational Damage Trust is the bane of every banking institution. It’s so easy to know why customers place so much trust and expectations in their banks to keep their information safe. Terribly, data breaches shatter this relationship. While the same customers may grant other industries a second chance, they don’t give banks the same regard (money is a factor). Once a data breach occurs, the trust is broken and the reputational damage irreparable. Compliance with Regulations Banks must comply with a number of data regulations to achieve maximum data protection and security. These laws were enacted by countries and industries to grant data subjects (data owners) more control over how organisations use their data. For instance, the GDPR governs the EU, and its requirements remain applicable to all organisations handling EU data regardless of their location. Also, all Nigerian banks are subject to the NDPA (Nigerian Data Protection Act). Under these laws, compliance is non-negotiable, and severe consequences follow traces of non-compliance. So, data security in the banking industry ensures data integrity and improves compliance with these strict laws. Financial Loss Not complying with data regulations comes with heavy financial implications. Why? The regulations place heavy fines on non-compliant organizations. For instance, the NDPC fined Fidelity Bank for the use of the data subject’s information without consent. Aside from the penalties imposed, there are several procedures necessary to minimise the impact of a data breach, and they don’t come cheap. This and lawsuits by customers puts banks in serious financial crisis. To prevent such sticky situations, banks are better off implementing maximum data security measures. It’s a ‘better safe than sorry’ situation. 5 Common Threats to Data Security in Banks With massive amounts of sensitive and personal data possessed, banks remain a constant target for cyberattacks. While the banks put up some kind of effort, the ever-evolving modus operandi of cybercriminals undermine it. Now, banks must stay aware of the potential types of cyberattacks coming and plan accordingly. Here are the banking sector’s most common cyberthreats. Phishing Phishing attacks remain the biggest thorn in the banking sector’s flesh. According to Statista, in 2023, around 27.32 percent of total phishing attacks worldwide targeted financial institutions. Cybercriminals pretend to be credible authorities and deceive individuals to reveal sensitive details like account number, credit card number, password, etc. Usually, these actors insert links to malicious websites in emails and text messages. When it comes to banking, there’s a special type of phishing called whaling. A common example is an email from a company’s CEO or top official to the finance department. The attacker, posing as the CEO, requests a wire transfer to an external account for a confidential deal. The attacker will include words or operational details to lend credibility to the story. This results in a terrible situation. Insider Threats Not all threats come from outside the bank; some come from inside the bank. Tired and disgruntled workers, contractors, and even third-party vendors pose risks to banking institutions. Because they can intentionally or unintentionally leak sensitive data to unauthorised persons. A real-world example of insider threat occurred in 2019. Capital One experienced a massive data breach when a former Amazon employee exploited a vulnerability in the bank’s cloud server to access sensitive customer information. The breach affected over 100 million customers and caused serious financial and reputational damage to the bank. Distributed Denial of Service (DDOS) DDOS attacks involve bombarding a bank’s online services with so much traffic that the system slows down or crashes. This act makes all online banking and payment unavailable, and it disrupts operations and leaves the system vulnerable to further attacks. Third-party and Supply Chain Attacks No organisation operates alone, and banks are no exception. At one point or another, the need to outsource tasks to external agencies pushes through. Banks rely on third-party vendors to supply various services, from cloud storage to payment processing, and this opens them up to more vulnerabilities. For an effective partnership, third parties need access to certain data, and they may possess poor data security practices. A hit on such a vendor equals a hit on the affiliated bank. Malware and Ransomware Malware is another threat to data security in the banking industry. Malware is malicious software (mal-ware) that attacks a system, steals data, and is even capable of a shutdown. Ransomware, on the other hand, locks users out of their own systems while the criminals request money in exchange for access. Ransomwares contribute a whole lot to the financial costs of data breaches—around $4.54 million, excluding the ransom cost itself. For example,

What is the Importance of Cybersecurity in Fintech in 2024

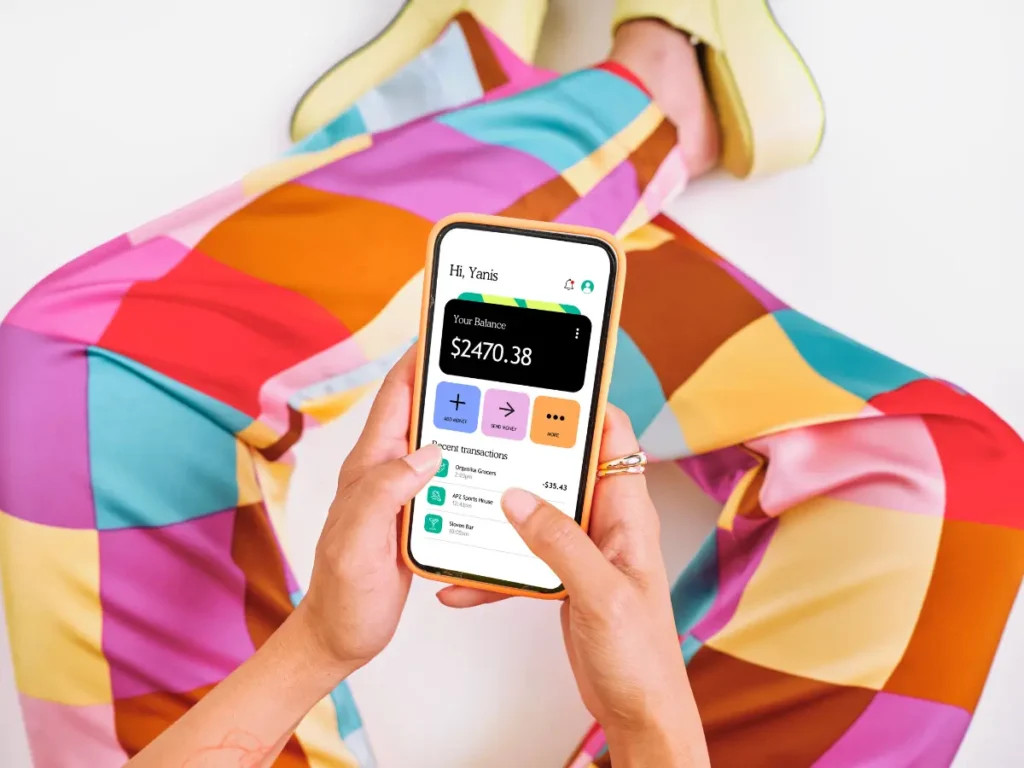

Fintechs are the main deal now. They serve as evidence of the massive digital evolution happening right before our eyes. As much as fintechs sound like the latest development, the collaboration between the financial and technological industries started with the first ATM. Now, the evolution has grown beyond simple ATMs and traditional banks to mobile apps and online payments. Currently, the entire financial sector uses one slogan, “customer first,” and the emergence of mobile internet made it easy. Bank users can access their accounts from any location using their mobile devices; no long queues at the bank, and no week-long transactions—fintechs embody the word ease. So, where does cybersecurity come in? This blog explains the importance of cybersecurity in fintech. Cybersecurity in Fintech: The Landscape Cybersecurity is the process by which every piece of data, software, and device in an organisation is protected from loss, compromise, and external. Cyber security differs from data security as it’s not limited to data only. It covers every mobile device, computer, drive, laptop, and software that belongs to the organisation’s network. Fintechs operate with large amounts of user data; to open an account, they collect BVN, emails, phone numbers, passwords, credit card details, and lots of sensitive data. What this does is attract vicious cybercriminals, who in turn use this data for identity theft, fraud, and targeted attacks. While fintech companies try their best to outsmart these malicious actors, they’re losing the fight. The situation worsens as cybercriminals use upgraded and sophisticated forms of attack. Certain technologies make it harder for companies to catch up, e.g., Artificial Intelligence AI. Cybercriminals use AI to constantly monitor the cybersecurity network of fintechs for entry points, and it gets the job done fast. Thankfully, there are cybersecurity tools to assist fintechs. Besides the sophisticated mode of cyberattacks, insider threats pose another challenge to cybersecurity in fintech. Records declare Fintech employees as one of the most cyberaware staff across various industries. But, in a recent survey, 49% of fintech staff admit they work around politics for work ease. While it’s a harmless intention, the result leaves room for data breaches to sneak in. So, what is the importance of cybersecurity in fintech? Here’s exactly why fintech companies need to implement cybersecurity systems. To prevent a data breach Presently, more and more companies fall victim to data breaches. In fact, research shows that 6 of 10 businesses fall victim to a cyberattack this year. And more often than not, these attacks are financially motivated, and personal data is the target. Sure, every company handles personal data at one point or another, but fintech companies are on a whole new level. Fintechs handle highly sensitive data that can make or mar their users. On September 11, 2022, Revolut, a financial transactions company, experienced a severe data breach due to a social engineering attack. The breach compromised the personal data of around 50,000 users, including their names, addresses, emails, and payment card information. To prevent a successful data breach and protect their customers, it’s important that fintechs establish a solid cybersecurity plan. To comply with data regulations The repercussions of a successful cyberattack, or data breach, affect the data subject (data owner) the most. For example, in a credit card or phishing effect, it’s the client’s money that gets stolen. Although unfavourable effects might reach the Fintech company, it is often the client’s headache. To grant data owners more control over their data, countries and industries alike established laws and regulations to guide organisations towards data protection. For instance, the organisations in the EU answer to the GDPR and its requirements while the NDPA protects Nigerian data. These data regulations hold companies—fintechs included—subject to them being accountable for the security of client’s data. So, they penalise non-compliant companies with hefty fines or even downtime. For instance, Fidelity Bank, a Nigerian bank, was slammed with a 555.8 million Naira fine in 2024, and many other financial institutions face such, if not worse. The importance of cybersecurity in fintech shines through the fact that fintech companies need it for maximum compliance with the laws. To prevent financial and reputational damage Unlike other industries, it’s extremely difficult for a fintech to bounce back after a successful data breach. Why? With each data breach occurring comes severe backlash. First, we have the reputational damage. No one would walk down an alley infested with bandits. Neither will a smart person keep money in a hole-riddled pocket. Such is the fate of fintechs. Consumers place a lot of trust—and sensitive data—in fintech companies that it’ll be hard to start over. So, fintechs must make cybersecurity important. The financial implications of a data breach cannot be explained enough (data breaches cost a lot). There are lawsuits from victim users, which take a huge chunk of money. Then there are direct expenses like forensic experts, hotline support, in-house investigations, etc. According to IBM, Organizations with a high level of noncompliance show an average cost of $5.05 million, 12.6% higher than average How To Improve Cybersecurity in Fintech Fintech security measures must continuously improve to counter the ever-evolving cyber-attacks. We have an idea of the challenges to cybersecurity in fintech, but how can fintechs overcome them? first, through regular security audits. Fintech start-ups and established companies should conduct an in-depth assessment of their security measures periodically. This allows them to spot and strengthen weaknesses in time. Also, as cybercriminals come up with newer modes of attack, a regular audit lets fintechs update their cybersecurity systems to prevent a data breach. Basic security measures like access controls, layered security, data encryption, staff awareness, etc. are essential to reduce the likelihood of a data breach. Fintech companies should implement access control on a need-to-know basis, so staff have access to only data necessary for their office. Also, access permissions should be reviewed and adjusted regularly to prevent loopholes. Data encryption technology should be implemented to keep data unreadable even when stolen. This technology keeps data safe ‘in transit’ or ‘at rest’.

Fintech and Data Protection: The Ultimate Guide to Safeguarding Sensitive Data

The coalition between the financial industry and technology started way before what we have now. Ever since the first ATM in the 1960s, the two industries became joined at the ribs. Furthermore, the evolution of mobile internet paved the way for better improvement in the financial sector. A quick look at the user-friendly and easy-to-use nature of fintechs reveals the stark difference from traditional banks. While fintechs give an aura of freedom, physical banks are often stuffy and brooding. Sure, we love these new developments—the easy transactions and zero-stress payment methods—but we need to consider fintech data protection. What’s the Importance of Data Protection in Fintech? Data is the one thing every business needs in varying amounts, and the sporadic growth of the internet means that organisations have lots of it at their disposal. So, do fintechs use data? Yes, they do. In fact, the category of data fintech companies use and store is very sensitive. We are talking about passwords, credit card numbers, account details, home addresses, etc., and these kinds of data attract the wrong attention. Here comes fintech data protection, which is how fintech companies safeguard data from compromise, loss, or unauthorised access. As a fintech company, there’s a ton of reasons you cannot do without data protection. First is regulatory compliance; as a result of the neverending occurrence of cyberattacks, countries and industries set down laws to oversee the act of safeguarding data. The GDPR for example, protects data of EU citizens regardless of the organization’s location. Similarly, organisations operating in Nigeria answer to the NDPA (Nigerian Data Protection Organisations). Is regulatory compliance necessary for fintech companies? Well, If they wish to boycott the fines and penalties of non-compliance, then they need to protect data. For confirmation, a 2023 report reveals that over 60% of fintechs pay at least $250 000 in compliance fines and one-third pay higher than $500 000. While fintechs are concerned with non-compliance fines, they’re more bothered about customer confidence. The nature of the financial industry doesn’t encourage data breaches because of the severe effects (identity theft, financial fraud, etc.). Once it happens, clients migrate immediately and may never return. Key principles of fintech data protection Data protection is not merely an obligation; it’s a cornerstone to fostering trust, transparency, and growth in the fintech industry. A look at the vast amount of data circulating in the fintech world: data protection must be done (the right way!). So, what are the key principles to fintech data compliance? Lawfulness, fairness and transparency Data collection, processing and storage must follow the lawful pathway and be for legal reasons. Data subjects (data owners) must be informed about the data being collected, the purposes, and their rights. This means that fintech companies have no right to collect, use, or even keep user data without informing the client. We’ll explore how this principle protects data later. Purpose limitation Data cannot be collected nor processed for reasons beyond the stated. If the need arises, fintechs must inform users about new developments. Data minimization Data collected must be relevant to the purpose for which it’s being collected. This principle works hand in hand with purpose limitation. It means that data should be adequate, relevant, and limited to what is necessary for the purpose of processing. Integrity and confidentiality appropriate technical and organizational measures must be implemented to protect personal data from unauthorized or unlawful processing and accidental loss Storage limitation and accuracy Users’ personal data must be accurate and kept up-to-date. As a result, fintechs must implement a system to detect and rectify all inaccuracies. Accountability Fintech companies are held accountable for compliance with the above data protection principles. So, they must be able to defend their compliance. To do this, regular risk assessments and appropriate governance structures must be carried out in addition to employee trainings. Beyond, fintechs should create a data protection framework that addresses issues like third-party access, cross-border transfers, and data breaches. Challenges To Fintech Data Protection The journey to data protection for fintech companies would’ve been smooth, but for the challenges it faces. The challenges to fintech data security lower the efficiency level of the system but are also combatable. Let’s look at a few of them. Cybersecurity Threats The financial sector took advantage of the widespread mobile internet to introduce easy transactions and place the customer first. While it produced desired results, the sheer amount and nature of data fintechs use makes them vulnerable to cyberattacks like phishing, hacking, ransomware, etc. A report by Statista confirms the financial industry as one of the most cyberattacked industries, as it takes the no. 2 position. Now, these threats operate in such a vicious and never-ending manner that it takes more effort for fintechs to gaurd against them. Take AI as an example. Cyberminals use AI to scrutinise Fintech’s defence system for vulnerabilities, and it does the job faster than the victim company can rectify the situation. Insider Threats Based on facts, fintech employees are regarded as one of the most security-conscious across various industries. Regardless, their actions, particularly unauthorised access, contribute to the threats to data. A prime example of this is the “NDPC fines Fidelity Bank” fiasco, where the bank (maybe a staff member) used the client’s data without her consent or knowledge. And that’s not even critical. There are situations where cybercriminals exploit the organisations due to the careless nature of the staff. In a recent report, about 49% of fintech staff admit to bending the rules for work ease. Third-party Risks Most times, fintech companies collaborate with other organisations that need access to user data. This practice poses more challenge to fintech data protection as the third party may have weak data protection practices. All it takes is one hit for cybercriminals, and every available piece of data is compromised. Data Protection Measures For Fintech Companies Prevention, they say, is better than cure. The saying rings true for fintechs, and here are some protection measures they can apply. Understanding Regulatory

What Does Data Security Mean for Fintech Companies in 2024?

Data security is a major concern for every business in every industry, fintech inclusive. For enterprises in other industries, securing data might be an afterthought, but fintech companies do not have that luxury. In this blog, we’ll go over data security and what fintech security looks like in 2024. The nature of data the financial sector handles is too delicate to handle without a proper security system. We’re talking about credit card numbers, age, addresses, bank account numbers, etc. The damage one successful data breach can cause can’t be imagined. What’s data security? Data security is the process of safeguarding data against external threats to it’s confidentiality, integrity, and accuracy. Fintechs have to consider data security to fight against the constant and ever-evolving barrage of cyber threats. Besides cyberattacks, regulatory bodies like the GDPR mandate data security as a sign of compliance. So, to be on the safer side, every fintech needs to up their security game. Fintech Security: Overview of the Landscape The condition of fintech security is dire; in the first quarter of 2024 alone, lots of fintech companies became victims of malicious actors. The reality of these statistics further worsens as the onslaught of these attacks becomes more vicious with time. Cybercriminals come up with newer and better technologies faster than the fintech industry; it’s a wonder how we have any fintech companies left. For example, consider the use of artificial intelligence. While it’s a development with plenty of benefits, cybercriminals found use for it. With AI technology, malicious actors scan the data security system of the target company and find weak links frequently. The advancement of this tech makes it easier for them to compromise the system and wreck havoc undetected for a long time. Also, there are laws established to regulate data security like the GDPR, PCI-DSS, NDPA, and so on. With these come stringent rules like the GDPR requirements. So, aside from data breaches, reputational damage, loss of consumer trust, and poor fintech security attract fines and penalties from data protection laws. Nevertheless, the financial industry constantly puts up a fight—albeit not enough—and we look forward to better data security technologies. Now, let’s move forward. What does data security mean for fintech companies in 2024? Here’s a better breakdown of the fintech security landscape. Advanced Threat Detection and Prevention Yes, cybercriminals like hackers attack with more sophisticated technologies. But fintech companies counterattack with a better principle: prevention. Now, financial institutions employ technologies like AI that allow them to monitor their systems for suspicious activities. These tools act like a smoke detector in the sense that, before a data breach occurs, they alert the organisation of its potential. This way, cyber threats like ransomware and phishing are cut short before they cause damage. Although AI is a useful tool, fintech companies need to maximise its potential. How? By developing more AI models that predict vulnerabilities in the system rather than just detecting attacks in progress. That way, they can strengthen their weaknesses and give swift responses to cyber threats. Compliance with Regulations Fintech security got tougher with the enactment of several data protection laws. Governments are clamping down on personal data protection, and there are consequences to non-compliance. For instance, in the EU, organisations answer to the General Data Protection Regulation (GDPR) and it’s stringent requirements. The law enforces a large amount of money as a fine, and that’s on a lighter note. Apart from territorial laws, each industry has its own set of regulations, and the number keeps increasing. To keep track of compliance with the many laws, the best thing to do is hire a data protection service consultancy. These are organisations that help businesses achieve maximum compliance with data protection regulations. At Johan Consults, we carry out a detailed assessment of your company’s security system, measure it against the requirements, identify your weaknesses, and provide solutions to them. Contact us now for a free 30-minute consultation. Zero Trust Architecture Like the name implies, this data security model works on a “never trust, always verify” principle. Usually, any user or device in a fintech company can access all data held, but this principle kicks against it. This new practice now insists on proper verification before data can be accessed. It’s more like having to use an ID to enter a room in a secure building. The benefits of this architecture are many. Now, each employee, user, or device can access only the data they’re allowed, and lots of data breaches have been detected. End-to-End Encryption and tokenisation Since a data breach seems unavoidable, fintech security adapted to the terrain. Now, fintech companies employ data security practices like encryption: turning data into secret codes unreadable without the key, and tokenisation: replacing characters in data with random characters, e.g., replacing digits with asterisks in credit card numbers. So even if hackers get the data, they can’t access it. These practices keep payment information and other sensitive personal data from unauthorised access. User Awareness and Education Fintech companies understand that data security goes both ways: for the company and its customers. While individuals rely on the companies to protect their data, they fail to acknowledge their contributions. In 2024, fintech companies are changing the narrative by organising programmes that teach customers how to prevent breaches. Users are educated on how to spot phishing attempts and suspicious links and reduce the risks of being hacked by using multi-factor authentication. Identity Verification and Biometrics Fintech security in 2024 is tighter than ever before with the introduction of identity verification and biometrics. Fintech companies now use more than just passwords to verify identities. There are behavioural analytics that check and record how a user interacts with the system, which makes it harder for hackers to impersonate victims. In addition, they might require a fingerprint, analyse a typing pattern, or even the way someone holds their phone. It’s all for added security, and it’s yielding the desired results. Cloud Security and Data Sovereignty Instead of physical servers, many companies opt for cloud storage for data-online storage.

All You Should Know About Fintech Cybersecurity

Cybersecurity is the practice of protecting data, computers, servers, mobile devices, software, and all other hardware from malicious attacks. One thing is sure: the most valuable resource in today’s world is data, and it’s a justified fact. One look at the world, and we see an unfathomable evolution—digital transformation. Every industry has begun to embrace the digital space, and financial institutions are not left behind. While we welcome the collaboration between technology and the financial industry, there’s a need to stay on top of the challenges it brings. So, as an individual who finds mobile payments lifesaving or a fintech startup trying to prevent cyberthreats, this article is for you. Read on for the importance of cybersecurity in fintech, the challenges it faces, and the best practices to encourage it. Cybersecurity in Fintech: The Landscape Over the last few years, business as we know it changed, especially the financial industry. The fusion of finance and technology has changed everything. But the dangers increased just as much. When it comes to cybersecurity, the fintech industry can be described with one word, “sensitive,” and its synonyms. Why? To carry out financial transactions on behalf of clients, sensitive data like credit card details, account balances, and pins needs to be stored. Now, cybercriminals attack fintechs for these data—it’s that important. And the modus operandi of these malicious actors do not remain stagnant. They constantly come up with newer and better technology that outsmart whatever defence fintech companies use. All thanks to AI and self-learning software. So, what are Fintechs doing about it? According to Gartner, 75% of companies intend to adopt new solutions that combat the growing global cybersecurity issue caused by new technology challenges. Fintech companies now embrace new cyber solutions and establish partnerships to strengthen their systems against online attacks. Although the careless attitude of employees constitutes some of the chinks in cybersecurity in fintech, fintech employees are part of the most cyber-aware among other industries. To combat the loose-employee side, fintech companies now support cybersecurity with new and better ID solutions. So, let’s move to the fun part. Importance of cybersecurity in Fintech To start with, cybersecurity in fintech serves as a shield for invaluable financial data such as personal information, account details, and transaction details. The consequences of a data breach in the industry can be catastrophic, going beyond identity theft and financial fraud. Implementing cybersecurity is not just a luxury but a necessary practice. It’s important to keep the trust users place in these institutions. When a data breach occurs, fintechs face massive reputational damage, the likes of which they might never recover from. It’s a case of “once bitten, twice shy.” Victims of financial fraud will never trust the institution anymore. To prevent eventual shutdowns due to customer migration and legal consequences, implementing cybersecurity in fintech is crucial. In addition, there’s a need to note that each individual fintech company’s part of a larger network. So, a successful cyberattack in one company is detrimental to others in the industry. To prevent a chain reaction, cybersecurity is best established. The challenges to cybersecurity in fintech Here’s a list of things that make cybersecurity more than a walk in the park Data breaches A data breach occurs when an unauthorised person gains access to personal and sensitive data. This can trigger negative consequences due to the nature of the breached data. For instance, there’s credit card fraud, where cybercriminals clear the victim’s account. And identity theft, when malicious actors perpetrate evil with the victim’s identity. As a fintech company, you must ensure adequate cybersecurity to prevent such occurrences. If not, the consequences will be dire. Insider threat An isider threat is a security risk to data that comes from inside the organisation—the staff. While fintech employees are more aware of cybersecurity than other industries, they aren’t perfect. According to research by the think tank EndPoint Ecosystem, a little over 50% of finance workers believe security policies restrict the way they work, and 49% confess to finding a way to work around their security policies. This shows how much insecurity surrounds data in the fintech world. New technologies The emergence of sophisticated technologies heralds progress and spells doom at the same time. Yes, some technologies are welcome, like the blockchain. Blockchain technology provides a decentralised and immutable ledger that can improve the security and transparency of financial transactions. But other technologies like AI and IoT increase the vulnerability of cybersecurity in fintech to cyberthreats. For example, IoT devices serve as an entry point for cyberattacks, while AI-powered attacks easily find loopholes in the security system. With these, fintech companies best implement authentication and other access control methods to guard up. Compliance with regulations There’s a host of data protection regulations out there, and fintech companies are bound to a few of them. Some of the key data regulations include the General Data Protection Regulation (GDPR), the Payment Card Industry Data Security Standard (PCI DSS), and the Federal Information Security Modernisation Act (FISMA). Non-compliance with these data regulations results in harsh penalties—either monetary fines or outright shutdowns. Now, GDPR compliance does not come cheap; it has some particularly expensive requirements, such as hiring a Data Protection Officer and conducting DPIAs (Data Protection Impact Assessments). The cost of compliance poses a challenge to cybersecurity in fintech, especially startups. Third-party risks Third-party vendors help the fintech industry a lot, especially startups who need to outsource services. Yes, they offer lots of assistance, but they bring additional risks to cybersecurity in fintech. Some third parties may not ensure adequate security against cyberthreats, and any fintech doing business with them becomes vulnerable. The way forward is to make sure to outsource tasks to third parties with adequate cybersecurity measures in place. Best practices for cybersecurity in fintech Since we know the common cybersecurity threats in fintech, now’s the time to learn how best to prevent them and limit their impact. Here’s a list of the best cybersecurity practices for fintechs. Conduct regular audits Regular security audits will help you identify and

Top 6 Data Security Challenges Enterprises Face and How to Mitigate Them

Data security has always been important to businesses. But nowadays, its vitality becomes more pronounced. Why? The use of data is tightly woven into the day-to-day activities of enterprises now more than ever. From marketing to competitor analysis to payment methods, data, particularly sensitive data, has earned its keep. Today, we’ll go into the common data security challenges enterprises face and how to mitigate them. What’s going on? Just before we launch into the challenges, let’s take a minute to familiarise with the terrain. It’s important to note that organisations constantly stage a fight—a losing one nonetheless—against cyberattacks of all kinds. The increased spending on cybersecurity in recent years proves that enterprises take the whole thing seriously. Regardless, the data security challenges still seem insurmountable. Why is data security important? The evolution of the workforce from traditional to remote and hybrid created wide gaps in the organisation that let cybercriminals in. and these vulnerabilities expose the enterprise to several consequences ranging from mild to severe. First, there’s unnecessary expenditure. To curtail the effects of a data breach, lots of money will be spent. Although some companies take out insurances to cover the cost, it doesn’t get the job done every time. Factor in the lawsuits from affected customers, and the numbers can only go higher. There’s also the reputational damage to consider. Seeing as no one would trust a brand prone to losing data integrity to constant cyberattacks, organisations need to embrace data security to avoid terrible fates. Also, data protection regulations around the world emphasise the importance of data security. For instance, the General Data Protection Regulation (GDPR) mandates appropriate data security measures as part of its basic requirements. And non-compliance comes with hefty fines and penalties. In 2022, Facebook was fined €265 million after personal data (facebook IDs, location, phone number, email address, etc.) was found on a website for hackers. Another instance: The British ICO issued a €20.4 million fine to Marriott International for failing to secure customers’ personal data. This incidence compromised almost 339 million guest records—personal and sensitive data included. Top data security challenges enterprises face Although businesses now take bold steps towards data security, it still isn’t 100% sufficient. There are some challenges that make securing data stressful—if not impossible. Here’s a compilation of a few data security challenges enterprises face for awareness sake. One thing’s sure: different operational teams make up a successful enterprise. Since data is the heart of each activity, each operational team will have it’s own data and database—very good and efficient. Now, where the problem lies is visibility or transparency. For large organisations with numerous departments, the central team (admin) usually finds it difficult to keep track of every piece of data used, stored, etc. by each team. This makes data security tedious; why? Without knowledge of what’s what, we can’t know exactly what security measures to use. Nowadays, individuals generate large amounts of data daily, which organisations in turn use. Sounds nice and cool till it’s time to secure it. Although large corporations benefit greatly from their large pool of data, securing it requires so much technology, money, and effort. The sheer amount of data leaves several ends unprotected and grants cybercriminals an attack opportunity. In addition, employees use repeated passwords to access personal and professional devices and even connect to insecure networks. That way, they unknowingly leave the door open for malicious actors. With malware becoming very easy to use, malicious actors need alarmingly little to cause significant data issues for their target. Managing cloud and digital infrastructure is a task that requires top-notch skills. You can’t just pick up any John Doe on the streets to help secure data; professionals are needed for the job. Normally, it’s not easy getting skilled workers in any industry. That the “great resignation” is affecting many organisations, the lack of skilled workers poses a challenge to data security for enterprises. Although data breaches disturb the operations of the organisation, customers and clients end up on the receiving end. At the end of the day, it’s the personal data of the individual that leaks. So, to curb these, data protection laws and regulations were enacted. These regulations, like the GDPR of the EU, the Nigerian Data Protection Regulation (NDPR), etc., grant data subjects (data owners) more control over their data and how it’s used. As a consequence, they pose a challenge to enterprises due to their stringent rules. Next is the cost. To properly comply with data security laws, organisations need to implement functional systems to keep track of compliance activities, e.g., GDPR compliance software. And such software doesn’t come cheap. Besides the cost of procuring these systems, their installments don’t come cheap. That’s not including the regular upgrade and cost of hiring a data compliance officer. While growth is a welcome development in every institution, it comes with inconveniences also. Managing data security and privacy solutions can test even the most experienced professionals in the field. For one, budget doesn’t always increase with the pressing demand for better security systems that growth brings, putting treams already struggling with data security under more pressure. The urgent need to install new systems quickly may lead to a situation where maintaining control becomes a concern for CISOs. Remote work is now part of the grand scheme for enterprises that wish to stay up-to-date and retain talents. In fact, it’s recommended that every organisation finds a way to embrace remote work fully, or at least, try out hybrid work mode. Then, securing each endpoint becomes necessary to protect the enterprise. The new landscape and policies that come with hybrid work prove a challenge to data security. This concludes the top 6 data security challenges enterprises face. Tips to mitigate these challenges Now that you know what challenges you’ll most likely face, here’s how your organisation can improve data security. Reduce the attack surface This is achieved by placing an access limit on sensitive data. This additional security control pops up right before accessing critical business info. This approach, referred to as the zero trust